Data based analytics and intelligence practices typically continue to grow complex over time. This is because we get more data over time, computational power is becoming cheaper by the day and businesses are facing situations where they can either innovate or perish.

Same applies to our case study. There are various levels of complex analysis which can be applied to this business once we start getting more and more customer information / data. In this concluding part of the case study, we will talk about framing targeted marketing strategies through propensity modelling or simple segmentation.

[stextbox id=”section”]A quick Recap : [/stextbox]

You have recently started a Video CD rent shop. After 2 months you realize that there is tough competition in the market and you need to make a more customer-centric strategy to stand out in the market. You have already built all the datasets and collected data for first 2 months (Read part 1 here). After 2 months, you used insights from portfolio data to define your mass market strategy and acquisition target localities (Read Part 2 here).

Now, you are in 5th month and business has grown to 750 customers. You have 4 months of data now and are wondering how to make your strategies even more customer-centric?

[stextbox id=”section”] Month 5 : [/stextbox]

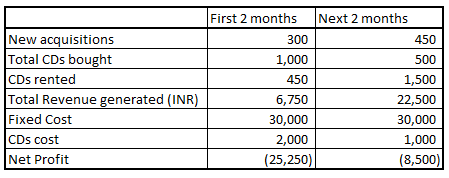

Here are some high level metrics for your business :

Till this point, all your analysis has been on portfolio level. You, want to create a more granular optimized marketing strategy. Here, we will use one the best industry approach to classify our customer portfolio into meaningful segments and then define targeted strategies for each of them.

Predictive modelling is still out of reach because of relatively small size of portfolio and data points.

Targeted engagement Strategy :

Step 1 : Form group using RFM approach :

This is one of the best and most commonly used technique. It is very quick to implement and its flexibility makes it easy to apply it across industries. This technique can be used in multiple ways. Following is a demonstrative example:

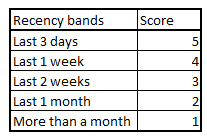

THE R : R stands for measuring Recency. In this case, we will take into account the number of days since the customer took the last CD. We will score each customer based on the band he qualifies.

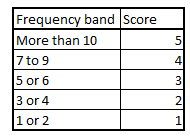

THE F : F stands for frequency. In this case, we will want to know the total number of CDs a customer has rented in his entire lifetime with us. Again we will band the frequency and score accordingly

The M : M stands for Monetary. Because, in our case each product costs the same, monetary parameter will behave very similar to frequency, there is no use of this metric.

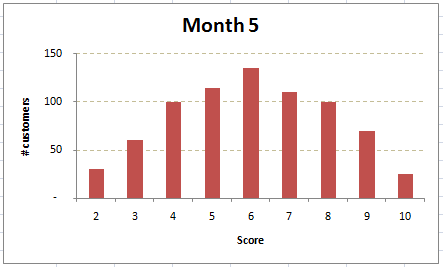

Let us consider a case, customer X has bought 8 CDs in total and bought his last CD 6 days before. His total score becomes 8/10. Similarly, we score each of the customers. First thing you need to check is the distribution and the stability of the score. Following is the distribution of scores as on month 4 and month 5:

Both the curves are approximately normally distributed and have similar proportion of population in each score band.

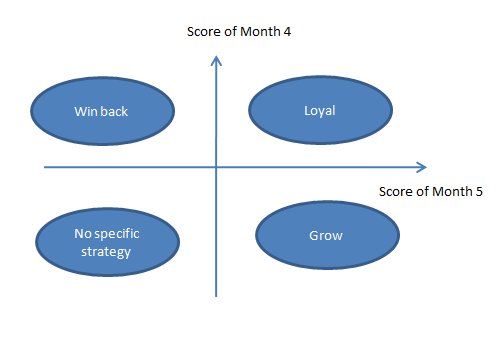

Step 2 : Find the profile of each customer using scores of 2 months :

For example, a customer with high score in both the months fall into loyal bucket (1st quadrant).

Step 3 : Find the right strategy for each of the groups

Loyal customers : These are the customer who were highly valuable and are still highly valuable. This segment is our loyal base and it is important to delight these customers because they give us a constant stream of revenue. All our customer delight / engagement strategies need to focus on these customers. Let’s list down a few of these possible engagement for “Up-selling” :

1. Based on the preferred genre, send updates of new releases or newly acquired CDs.

2. Send weekly updates of star rating on new movies of preferred genre.

3. Send festive promotional offers to up-sell.

4. Give free delivery services.

Grow customers : These customers are showing a growing pattern and are becoming more and more engaged with us. The right strategy with these customer is to delight them and grow their engagement further. We again add these customer to the up-sell group. A similar strategy as of Loyal customer might be helpful in making them more engaged.

Win back customers : These customers are showing a declining pattern in terms of engagement/revenue. Here we need some different set of strategies to arrest their likely attrition and bring them back. If we think about it, there are possibly 2 reasons for their possible attrition:

a) They are now shopping from other shops

b) They have declined their overall requirement

Let’s try to list down some strategies to increase their wallet share or transfer their demand from other vendors to our store :

1. Win back offers : Give promotional offers to get them back on books. Offers like ” Buy 2 CDs a month and get third 50% off” will differentiate us from other vendors.

2. Customer specific engagements : Customer all wants to be treated deferentially. A simple promo offer like ” Get 25% off on next CD” might not work as good as ” We know you like watching Romantic movies. Here is “If Only” one of the best in genre 15% off only for you”.

Other strategies :

There can be many other data driven strategies, which can be implemented at this point in time. Some of these strategies are as follows :

1. Inventory optimization model based on past demand trends

2. X-sell of other rental services to loyal customers like renting home theatre.

3. Mutually share data with Home theater store and bring off-us customers with profile similar to loyal customer on board.

[stextbox id=”section”] End Notes : [/stextbox]

Strategies discussed in this article are meant to be food for thought for the viewers. These are by no means comprehensive. If you have examples of techniques, which you implemented in your industry and can be useful for this case study, please share them for benefit of wider community.

At some point in future, I will also cover how can this business use predictive modelling once it starts operating on a larger scale.

Hi, Nice case studies to begin with. As i am working for a telecom sector and very much interested in knowing some case studies related to that, like in south India the vodafone basket their profit to 100 crore in 2013 financial year for Q3-Q4. Now he wants to increase his profit from 100 crore to 110 crore in Q2-Q3 for financial year 2014. So for this case studies it will be helpfull if you can focus on what are the KPI's that we should look for, how to go for customer centric approach. Thanks & Regards, kumar

Avinash, Thanks for reading . To make a customer centric strategy, you should give higher weigtage to customer preference metrics. Say, even if you find the expected profit of pushing product X to a customer higher than product Y, but the customer actually prefers product Y. Customer centric apporach will bring you to the solution of offering product Y to the customer even at a cost of not selling a higher profitable product. But in general customer centric approach will converge to the same solution as that of maximizing the profit. We have recently published an article on customer centricity, which include some relevant case studies. Click here (http://www.analyticsvidhya.com/blog/2014/03/analytics-helps-organization-customer-centric/) to view this article. Hope this helps. Tavish

Very nice case study and well explained with details..

Thanks Swapneel

Hi Tarun, Very Interesting case study!