Could the 2008-10 American recession have been avoided with machine learning (ML) and artificial intelligence (AI) to predict market trends, detect risks, and uncover fraud? Recent advancements in finance suggest yes. Today, intelligent security systems and efficient customer service are key to success, and ML and AI are driving this transformation. This article explores what makes ML unique and how top financial institutions are leveraging it effectively. Let’s dive into the applications of ML and AI in banking and finance for 2025.

Table of Contents

- Why Use Machine Learning and AI in Banking?

- Top 4 Ways in Which Machine Learning has Impacted Banking and Finance Industry

- Banking Processes That Use AI

- Credit Scoring

- Onboarding and Document Processing

- Fraud Detection And Compliance

- Improved Investment Evaluation

- Personalized Offers

- Reduced Operational Costs And Risks

- High-Tech Trading

- Handling False Positives

- Loan/ Insurance Underwriting

- Risk Management

- Client Assistance

- Document Analysis

- Trade Settlements

- Money-Laundering Prevention

- How Does No Code ML Benefit Banking and Finance Professionals?

- Conclusion

- Frequently Asked Questions

Why Use Machine Learning and AI in Banking?

ML and AI allow machines to carry out various complex activities on our behalf. In times when technology has penetrated almost all sectors, financial institutions must use cutting-edge technology to keep ahead of the curve to optimize their IT and satisfy the most recent market demands. To explain this a little, here’s why ML and AI should be used in banking.

- The financial services sector is progressing thanks to machine learning applications in banking. Thanks to new cutting-edge solutions, financial institutions can now turn the unending stream of data they regularly produce into useful insights for everyone, from the C-suite and operations to marketing and business development.

- Businesses are turning to machine learning use cases in finance to improve security, user experience, support, and practically gapless processing.

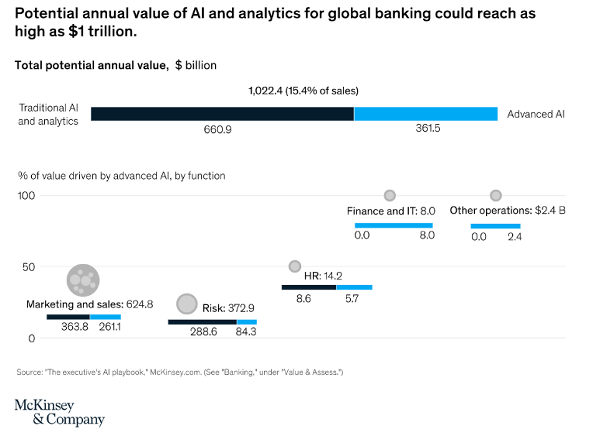

- According to McKinsey, the cumulative benefits are so great that the annual potential value of AI and analytics for global banking might be as high as $1 trillion.

Top 4 Ways in Which Machine Learning has Impacted Banking and Finance Industry

Machine learning is the process of taking in enormous amounts of data and learning from it how to carry out a certain task, like telling fake legal documents from real ones. The finance sector provides an abundance of complex and enormous volumes of data, which ML excels at managing. Here are 5 ways in which machine learning has impacted the banking and finance industry:

Anomaly Detection

Anomaly identification is one of the most difficult tasks in the asset-serving division of companies. Accidents or system flaws in routine procedures can result in anomalies. Anomalies must be identified in the fintech sector because they could be connected to illicit actions like account takeover, fraud, network penetration, or money laundering, which in turn can lead to unanticipated results.

- The problem of anomaly detection can be approached in various ways, and machine learning is one of them. Financial machine learning anti-fraud systems can identify minor user behaviour patterns and connections.

- To determine the possibility of fraudulent transactions, it can process massive datasets and compare a variety of variables in real time.

Payments

The use of machine learning in payment procedures is advantageous to the payments sector as well. Thanks to technology, payment service companies can lower transaction costs, which increases customer interest. The ability to optimize payment routing depending on pricing, functionality, performance, and many other factors is one of the benefits of machine learning in payments.

- Machine learning systems can efficiently distribute traffic to the highest-performing set of variables by processing a variety of data sources. With this capability, financial institutions can provide merchants with the greatest outcomes based on their unique goals.

- There are several machine learning apps for finance available today, which are great tools for businesses to use to create substantial value by resolving common issues. Payment service providers can determine whether a transaction should proceed or be forwarded to a two-step verification page first with the aid of machine learning in payment processing.

Robo-Advisors (Portfolio Management)

Online tools called robo-advisors offer automatic financial advice and support. They offer portfolio management services that automatically create and manage a client’s investment portfolio using algorithms and data.

- These online investment platforms make the process of investing simpler, which can be otherwise intimidating for some people. In addition, using these services is significantly less expensive than hiring a financial advisor. Furthermore, many of them only have minimal or nonexistent account minimum requirements. Betterment and Wealthfront are two online investment firms whose robo-advisors offer portfolio management or financial counseling online or through a mobile app.

- These businesses are online financial advisors that assist clients in managing their finances by utilising technology. For investors, Betterment employs algorithms to recommend a suitable asset allocation. Based on how investors respond to inquiries like “How do you plan to use the money?” and “What is your time frame?” this conclusion is drawn.

- Wealthfront uses technology’s impersonal benefit to offer its investment services. Its software is set up to execute tried-and-true investment strategies, find superior investment possibilities automatically, and maintain the ideal investment mix over time.

- One of the biggest digital wealth managers in the UK is Nutmeg. The Nutmeg robo-advisor allocates funds to a diversified portfolio based on information about a person’s financial objectives and risk tolerance.

Algorithmic Trading

By periodically delivering little portions of the order, known as “child orders,” to the market, algorithmic trading makes it possible to carry out a huge transaction. Therefore, machine learning in finance is primarily used by hedge fund managers, who also use automated trading systems.

- In order to maintain a competitive advantage, it enables traders to automate specific operations.

- Also, the technology enables operation across different marketplaces, enhancing trading prospects.

- Another competitive advantage for those institutions that use machine learning in finance is the algorithms’ capacity to learn and react to real-time developments.

Banking Processes That Use AI

Banks use machine learning systems for a variety of purposes. The most frequent advantages that ML and AI provide to banking and financial businesses are listed below.

Credit Scoring

The most potential application of ML in banking is arguably credit scoring. It assesses a customer’s ability to pay and how likely they are to make plans to pay off debt. Credit scoring solutions are desperately needed because there are billions of unbanked people around the globe, and only around half of the population qualifies for credit.

- Work experience, overall income, transaction analysis, and credit history are just a few of the different pieces of information that go into machine learning scoring judgements.

- It is a mathematical model that is based on statistical and accounting principles. As a result, machine learning algorithms can generate more accurate, sensitive, and tailored credit score assessments, enabling more people to access credit.

- Machine learning systems are able to grade borrowers objectively, unlike human scorers. Moreover, organisations can eliminate gender, racial, and other conscious or unconscious bias and serve a wider audience more equally with the aid of machine learning in banking.

- As you can see, ML in credit scoring offers a wide range of advantages, including the ability for customers to apply for loans in a few clicks from the comfort of their homes.

Onboarding and Document Processing

Traditionally, document processing has been a time- and labor-intensive procedure. In the end, machine learning can speed up the process of classifying, labeling, and processing documents.

- Optical character recognition (OCR) must first be applied to copies before machine learning algorithms can interpret the text on scanned documents to determine the context. The machine learning model classifies and indexes everything for future use with the aid of this data.

- Traditional banks still using paper forms for new client onboarding can benefit from machine learning-based document processing.

- Machine learning is a highly effective and scalable technique for onboarding, regardless of whether the data is an ID scan or an invoice. Customers can open a bank account in a few minutes and complete the essential checks in real time. Such applications of machine learning aid companies in creating beneficial and long-lasting relationships with their clients.

Fraud Detection And Compliance

For financial institutions, fraud is a huge problem and one of the main justifications for using machine learning in banking. Machine learning systems can detect fraud by using various algorithms to sift through massive volumes of data. Banks can monitor transactions, keep an eye on client behavior, and log information to extra compliance and regulatory systems to help minimize overall risk when it comes to regulatory compliance.

- Regardless of the number of customers or size, fraud is increasingly a challenge for many businesses in the fintech sector. Financial machine learning can assess big data sets of concurrent transactions in real time. At the same time, ML may reduce human input by updating models and learning from results.

- Financial institutions can use machine learning to recognize user activity, validate it, and respond to cyberattacks efficiently with machine learning. Automated fraud detection has now come to be associated with AI on a global scale. Now that patterns can be easily identified as abnormalities, businesses can intelligently predict fraud.

- AI and machine learning can increase real-time approval accuracy, and overall regulatory compliance can be improved. Then, in addition to saving financial institutions a tremendous amount of money, financial organizations can be more accurate and efficient in their processes.

- According to a Bloomberg report, fraud losses suffered by banks and retailers on all credit, debit, and prepaid general purpose and private label payment cards issued globally were £16.74 billion ($21.84 billion) in 2015.

Improved Investment Evaluation

The process of valuing an investment involves numerous intricate computations. The approach entails working together with several teams in charge of various facets of investment asset management, product experts, and portfolio managers. These teams ought to think about various investment strategies. An application that can handle massive volumes of data from different sources in real-time while learning biases and preferences for risk tolerance, investments, and time horizon is the ML answer for this problem.

Personalized Offers

Banks can learn what clients want and are prepared to pay for at any given time, thanks to a wide range of information about user activity. For instance, after assessing all potential risks and their solvency, banks can offer tailored loans depending on the advertisements the client was viewing. Improving the customer footprint enables banks to identify minor patterns in customer activity and develop more individualised customer experiences.

- Delivering exceptional customer experiences is currently one of the key success criteria in the banking industry, and machine learning may give banks a much better insight into their clients’ habits, requirements, and desires. Financial institutions can use this to boost customer loyalty, tailor their offers, provide AI-assisted wealth management services, and meet customer expectations in real time.

- For instance, clients can make smarter financial decisions with the aid of machine learning-based budgeting tools linked to mobile banking apps. A machine learning system may analyze user spending trends and make suggestions for ways to improve budgeting based on the history of transactions. To help its customers, TransUnion bank has teamed up with Mint, a budgeting tool powered by machine learning, to offer advice on raising credit scores. These tools promote client loyalty and raise client lifetime value.

Reduced Operational Costs And Risks

While interactions with others have numerous advantages, mistakes still happen frequently and can cause enormous losses. Even seasoned personnel are capable of making poor choices that affect the company’s responsibility. Because of this, financial institutions like banks actively incorporate ML and AI technologies into their daily operations. For instance, robotic process automation (RPA) software mimics digital operations carried out by humans and eliminates many of the processes that are prone to errors (for example, entering customer data from forms or contacts). Many banking procedures can be managed with the aid of natural language processing and other ML technologies, such as RPA bots.

High-Tech Trading

With India’s booming economy, data science and machine learning technology have made trading a relatively easy process for individuals who want to invest in the sector. Artificial intelligence can be used to improve rules, assist in making important trading decisions, and analyze important data. A mathematical model based on Big Data Analytics and Artificial Intelligence is used by startups in India like AccuraCap. Such trading algorithms, which are based on important information from public sources, have been adopted by numerous fund management companies in India.

Handling False Positives

False positives, commonly referred to as “false declines,” occur when businesses or financial institutions incorrectly reject requests for lawful financial transactions. Typically, this occurs when there are grounds for suspicion of fraud.

- Financial institutions suffer greatly from false-positive card declines because they risk losing their consumers’ loyalty if a business wrongly rejects their cards.

- According to a 2015 analysis by Javelin Strategy and Research, at least 15% of all cardholders had at least one transaction improperly denied in the prior year, resulting in a loss of revenue of close to $118 billion annually. Furthermore, 39% of cardholders whose cards were wrongfully refused indicated they stopped using their cards as a result. For businesses, this translates into decreased client loyalty and lost revenue.

- ML is the best method for addressing the issue of false positives, which frequently occurs in the banking industry.

Loan/ Insurance Underwriting

Another excellent use of machine learning in finance is here. Terabytes of customer data are available from banks and insurance companies, on which ML algorithms can be trained. Algorithms can carry out automated operations, including comparing data records, searching for exceptions, and determining whether a potential borrower is eligible for insurance or a loan. ML systems can now complete the same underwriting and credit-scoring processes that used to take tens of thousands of hours to complete by humans. Computer engineers train the algorithms to recognise a variety of trends that can affect lending or insurance decisions.

Risk Management

For their operations to succeed, large firms and financial institutions rely on precise market forecasts. Financial markets are rapidly utilising ML and AI technologies to make use of current data to identify trends and more accurately forecast impending threats. The banking sector’s risk management has been improved through machine learning.

- Several businesses using these cutting-edge technologies to assist financial and other organisations in managing risk include Dataminr and Alphasense. It claims that it finds important breaking news and high-impact events long before they make the headlines.

- Dataminr’s cutting-edge AI technology collects data and rapidly alerts clients, putting them in a position to respond to difficulties in real-time. Real-time public social media provides the company with knowledge on potential major events and breaking news that could have a significant impact.

- Alphasense approaches the task in a unique way. The business offers a search engine for significant investment and advisory firms, international banks, and businesses. The AlphaSense search engine focuses on important data points and patterns, saving clients valuable time.

- It locates and tracks pertinent information using natural language processing (NLP), learning from its wins and failures with each search.

Client Assistance

Better chatbot experiences have resulted from machine learning in finance, which has enhanced client satisfaction. ML-based chatbots can answer client questions with speed and accuracy because they have powerful natural language processing engines and the capacity to learn from previous interactions. These chatbots have the flexibility to adjust to each individual customer as well as changes in their behaviour. These systems’ financial expertise and electronic “EQ” were developed by the analysis of numerous consumer finance inquiries.

Chatbots have the ability to improve processes for customers and make banking easier and less frustrating. For financial organizations, technology will reduce the need for human labor and deliver accurate and current information at all times. More user-friendly chatbots are an example of machine learning in finance being used to the advantage of both banking organizations and customers.

- Major commercial banks are starting to recognize the strategic technology advantages of chatbots. As an illustration, Wells Fargo started testing an AI-powered chatbot in April 2017. In order to reset user passwords and provide account information, the chatbot connects with users using Facebook Messenger.

- Erica is a custom bot created by Bank of America (derived from America). Erica assists clients with routine transactions, offers money-saving tips, and provides information on account balances and credit card payments. Erica is accessible to customers through the Bank of America mobile banking app.

Document Analysis

Latest developments in deep learning have increased the accuracy of picture identification beyond what is humanly possible. One excellent application of machine learning in finance is document analysis. Frankly, the speed and precision of these ML systems are astounding. In a couple of seconds, a programme at JP Morgan called COIN finished 360,000 hours of work. Analysis of 12,000 commercial credit agreements was required for the task. Contract Intelligence, or COIN, interprets documents using machine learning. Legal and other papers may be quickly scanned and analyzed by ML systems, which enables banks to address compliance concerns and fight fraud.

Trade Settlements

Failing Trade Settlement can be Fixed by Machine Learning. Following stock trading, trade settling is the process of moving securities into a buyer’s account and money into a seller’s account. Around 30% of deals fail and must be manually settled, despite the great majority of trades being completed electronically and with little to no human contact. Machine learning can be used to not only determine the cause of unsuccessful transactions but also to analyze why they were rejected, offer a solution, and even predict which trades will likely fail in the future. What would typically take a person 5 to 10 minutes to mend a failed trade can be completed by machine learning in a quarter of a second.

Money-Laundering Prevention

A United Nations report states that 2 to 5% of the world’s GDP, or $800 billion to $2 trillion, is thought to be laundered globally each year. Money laundering would have the fifth-largest economy in the world if it were a nation.

- One of the world’s largest banks, HSBC, intends to fight money laundering by integrating machine learning technologies into its infrastructure. In an effort to identify indicators of money laundering, the AI program will gather internal, publicly available, and transactional data from a client’s larger network.

- Financial organizations are now able to switch from a static to a dynamic and predictive business model thanks to machine learning. The system extracts data from physical documents, identifies trends, and highlights abnormalities using optical character recognition (OCR) and progressive machine learning.

How Does No Code ML Benefit Banking and Finance Professionals?

Even a few decades ago, the world of finance was very different from the one we live in today. The size of transactions has significantly grown, to start. The increase in the number of transactions is related to the fact that the number of transactions has increased. In 1990, 14% of consumer transactions were performed via electronic means. Currently, only a quarter of consumer payments are performed in cash; most transactions are now computerised.

- Traditional algorithms are no longer sufficient because of the rising scope and complexity of banking. To detect financial fraud, verify financial transactions, examine loan applications, automate workflows, and other tasks, AI solutions are required.

- But the intricacy of AI technologies has also grown. Conventional AI is slow, expensive, and challenging to employ for many financial firms since it involves data scientists and software development. Thankfully, new no-code AI systems eliminate these obstacles and give business users access to a simple visual interface for building ML models.

With the aid of low-code or no-code AI tools, it’s becoming more and more common to create highly automated AI and ML solutions for finance that are suited to a company’s needs. According to a Gartner study, 65% of firms intend to employ low-code or no-code solutions to save software development costs and time-to-market, allowing them to adapt to market changes quickly. Even persons without substantial coding skills can design, change, and update apps that can provide a smooth user experience thanks to low-code or no-code AI.

- By offering flexibility and quick turnaround to produce quicker solutions and effective process implementation at a low investment compared to infrastructural investments to achieve identical results, artificial intelligence (AI) and low code play a vital part in the transformation of banking.

- Low-code development streamlines coding and application creation to give simple drag-and-drop capabilities, making application development more accessible and quicker than ever before. The technologies are crucial in laying the groundwork for the banking industry’s future since they enable the implementation of solutions in less time while maintaining or even increasing efficiency.

- By offering process improvement and time and resource savings, the adoption of AI and Low-code in banking has increased adaptability and robustness. Because the technologies are scalable, the institutions can make significant adjustments to meet changing consumer expectations.

- Due to low-code alternatives, these technologies enabled the integration of new digital-first processes that can be built and implemented at incredibly quick rates with current, safe client data. Business-rule-driven procedures may now be implemented fast by enterprises and enforced by artificial intelligence thanks to low-code platforms.

- Also, they promote human involvement in any disagreements or situations when trust in the AI decision may be necessary. Together, these rules start to work, allowing the business to process customer transactions more quickly, provide greater transparency into each transaction, and enhance customer experience.

- The availability of low-code and no-code frees the technicians for more difficult work because marketing or other departments can handle most or all of the development of an app or program, even though information technology still has oversight of the technology.

Conclusion

AI solutions are becoming a strategic requirement in the global finance sector, particularly in banking. They enhance the security, creativity, and effectiveness of financial services. AI and machine learning can increase sales through meaningful interaction. These trends offer opportunities for full-fledged professions and specializations. Courses on AI can help individuals understand the basics, and creativity is crucial for success in data science and machine learning positions. Have a look at AI courses offered by Analytics Vidhya here!

Frequently Asked Questions

A. Machine learning technology is used for a number of financial functions, including algorithmic trading, fraud detection, investment monitoring, and recommendation. Financial institutions can use machine learning to improve their judgments around pricing, risk, and client behavior.

A. ML can assist banks in promptly identifying user behavior, verifying it, and quickly and effectively retaliating to cyberattacks. With rule-based fraud detection, machine learning enables real-time skimming through massive volumes of data with minimal human involvement.

A. Because AI has a superior capacity for processing and deriving insights from enormous amounts of data, banks can benefit from lower error rates, better resource utilization, and the discovery of new and unexplored business prospects.